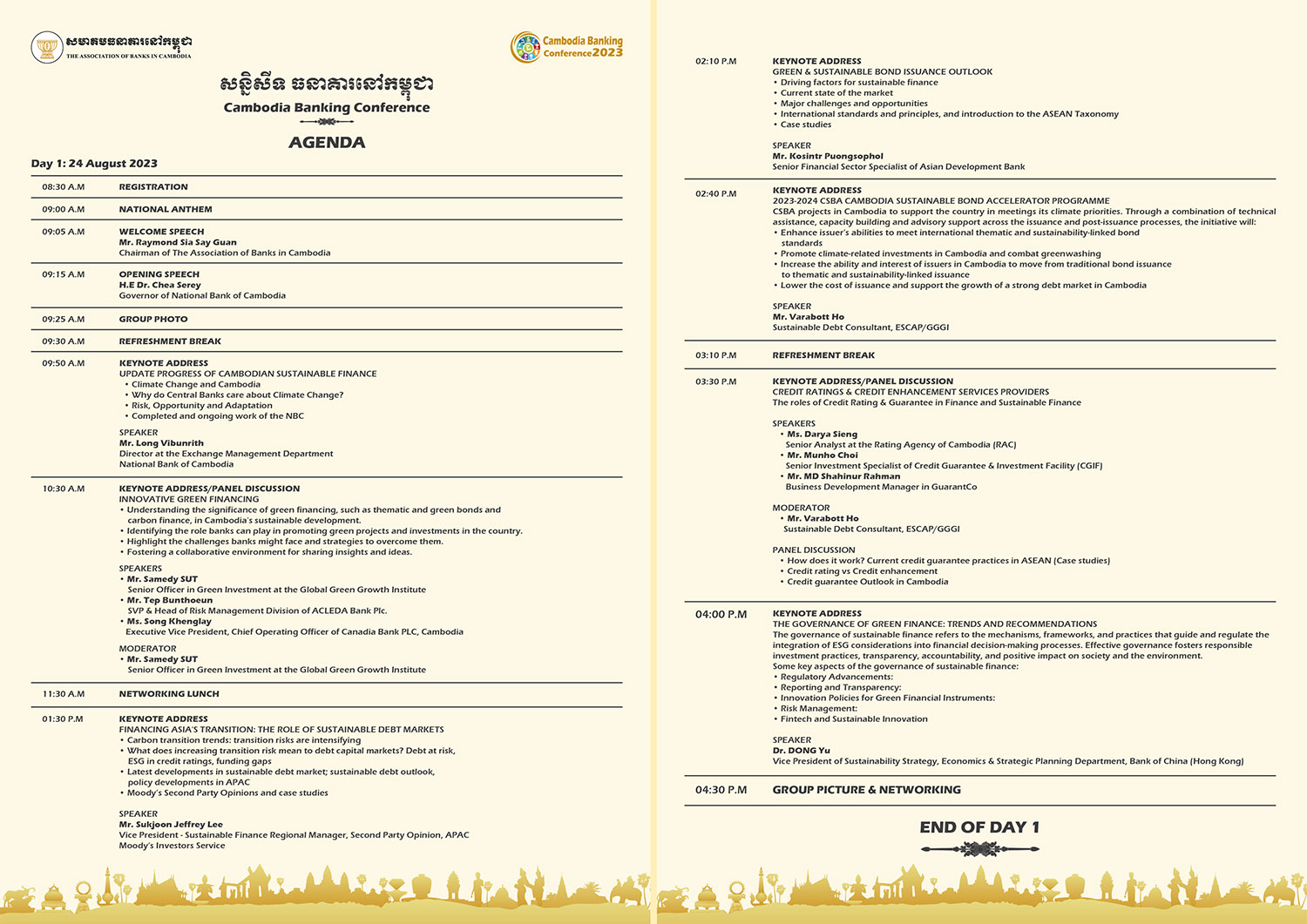

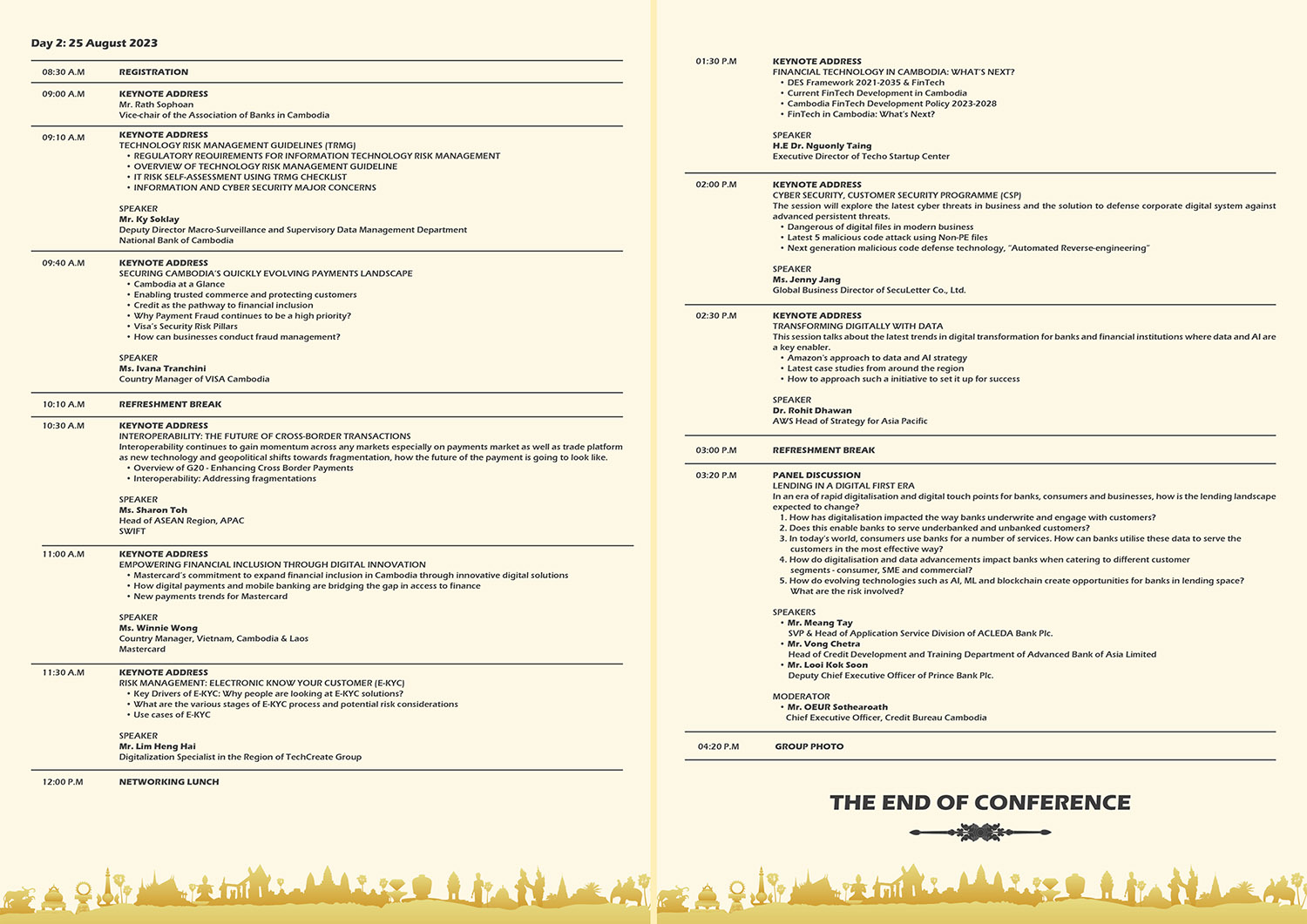

Cambodia Banking Conference 2023.

The Association of Banks in Cambodia (ABC) is committed to working in partnership with its member banks to promote sustainable development and green finance in Cambodia. The Conference on “Promoting sustainable and digital banking in Cambodia” is organized by ABC to bring together both key banking stakeholders and the public in the discussion on Cambodia’s transition to a greener and more sustainable economy.

The objectives of this conference include:

• To introduce the current state of sustainable finance, international trends, standards, advanced technologies, and innovations;

• Understanding the significance of green financing, such as thematic and green bonds and carbon finance, in Cambodia’s sustainable development.

• Increasing the coordination, role, and responsibility of banking in intensifying green development;

• To provide a platform for collaboration between the government, private banking sector and Micro-finance institutions on sustainable and digital banking in Cambodia.

REGISTER

Speakers

-

H.E Dr. Nguonly TaingExecutive Director, Techo Startup Center

H.E Dr. Nguonly TaingExecutive Director, Techo Startup CenterDr. Nguonly Taing has been appointed as an executive director of Techo Startup Center, which is a government-funded startup accelerator under the innovation arm of the Ministry of Economy and Finance of Cambodia. During his assignment, he has driven various startup accelerators including the Startup Cambodia national program, has led technical team to build Cambodia Data Exchange platform (CamDX), has been a principal investigator of FinTech research, and has led the applied research on Natural Language Processing. Besides, he has another active role as the Deputy Secretary General of the General Secretariat of Digital Economy and Business Committee where he coordinates the implementation of digital related projects, carrying out research activities and drafting policy under the policy framework of Cambodia’s digital economy and society.

Dr. Taing has more than 15 years of working experience in the software industry. Since 2009, he has been also a visiting lecturer on Distributed Systems and Machine Learning at the Royal University of Phnom Penh, Cambodia.

Dr. Taing received his B.Sc. in Computer Science from Royal University of Phnom Penh in 2002, Cambodia, M.Sc. in ICT from Waseda University, Japan, in 2009 and Ph.D. in Computer Science from the Dresden University of Technology, Germany, in 2018.

-

Ms. Ivana TranchiniCountry Manager Visa Cambodia

Ms. Ivana TranchiniCountry Manager Visa CambodiaCurrent Position and Responsibilities

Ivana is Visa’s Country Manager for Cambodia. In this role she is responsible for working with Visa’s clients, and industry and government stakeholders to develop Visa’s globally interoperable, secure and reliable payments network for Camodian consumers and businesses.Other Information

Prior to this role, Ivana was Visa’s Head of Products & Solutions for New Zealand & the South Pacific, where she led the industry efforts to implement Visa products and capabilities in a manner that created growth for the markets. She has also held Senior Sales and Corporate Communications roles for Visa in the Asia Pacific region for three years.Before joining Visa in 2013, Ivana had a 12-year career in corporate communications across payments and banking, as well as B2B consulting through global commnications agencies.

Through her experience, Ivana has built a broad understanding of payments from a global and local perspective. She has particular interest in the role of innovation in closing the gap between developed and emerging payments markets, and the learnings that can be shared across these markets relating to new technologies, regulation, ecosystem dynamics and operating models.

-

Mr. Lim Heng HaiDigitalization Specialist in the Region of TechCreate Group

Mr. Lim Heng HaiDigitalization Specialist in the Region of TechCreate GroupMr. Lim has more than 18 years experience in full software development life cycle (SDLC) and implementation of payment solutions in compliance with legal and operations framework. He was nominated as the Vice Convenor of ISO 20022 Payment Standard Evaluation Group, Singapore and is a member of ISO 20022 Registration Management Group since Nov 2015.

Key Achievements:

He had experience working with Singapore Clearing House as well as multiple major banks in Singapore, heading projects from end-to-end (from bank corporate and retail customer to bank, clearing house and settlement system operator) encompassing:

– Cheque Truncation System (including Disaster Recovery Centre)

– High-Volume, Low-Value Payment Systems – GIRO, Cheque, Real-Time Payment

– e-Payment and e-Cheque solutionQualifications:

– Master in Science (IT), University of Portsmouth, UK

-Bachelor in Business Studies (Banking), Nanyang Technological University, SG

-PMP Certified

Worked with the following Financial Institutions:

Singapore Clearing House, ANZ Bank, Citibank, CIMB, DBS, Deutsche Bank, HL Bank, HSBC, Maybank, OCBC, RBS, RHB, SCB, SMBC, UOB -

Ms. Jenny JangGlobal Business Director

Ms. Jenny JangGlobal Business DirectorJenny Jang is an accomplished professional with extensive experience in the IT and Cybersecurity industry. With a career spanning over 17 years, she has been at the forefront of global sales and business development, making significant contributions to various organizations in the field.

Currently serving as the Global Business Director at SecuLetter, Jenny is entrusted with the responsibility of spearheading business development and channel sales initiatives.

Industry Experience:

+Jiransoft, Korea (2017~2020)

• Senior Manager, Global Business

• During her tenure at Jiransoft, Jenny played a key role in the company’s global expansion efforts. Her strategic vision and exceptional leadership skills contributed to securing new business partnerships and expanding the company’s presence in international markets.

+Jiran, Korea (2008~2017)

• Manager, Global Business

• Jenny’s journey at Jiran was marked by consistent success as she led the global business division. She demonstrated an in-depth understanding of market dynamics and exhibited a talent for fostering strong relationships with clients and partners worldwide.

+COMSOC Technology, Singapore (2006~2008)

• Sales & Marketing

• Jenny’s career took an international turn when she joined COMSOC Technology in Singapore. In this role, she honed her sales and marketing skills and gained valuable insights into the Asian cybersecurity market. -

Mr. Kosintr PuongsopholSenior Financial Sector Specialist Economic Research and Development Impact Department Asian Development Bank

Mr. Kosintr PuongsopholSenior Financial Sector Specialist Economic Research and Development Impact Department Asian Development BankKosintr Puongsophol is a senior financial sector specialist at the Economic Research and Development Impact Department of the Asian Development Bank. He is a member of the Secretariat team of the Asian Bond Markets Initiative (ABMI), an initiative established by the Association of Southeast Asian Nations (ASEAN) and the People’s Republic of China, Japan, and the Republic of Korea to develop local currency bond markets in the region.

He is currently leading the ABMI’s initiative to develop a sustainable finance ecosystem in ASEAN+3, including advising governments and assisting potential sustainable bond issuers and other stakeholders. Furthermore, he is leading the implementation of the ASEAN Green, Social, Sustainable, and Other Labeled (GSS+) Bonds Initiative in Southeast Asia, a program under the ASEAN Catalytic Green Finance Facility. -

Mr. Varabott HOSustainable Debt Consultant, ESCAP/GGGI

Mr. Varabott HOSustainable Debt Consultant, ESCAP/GGGIVarabott is French-Cambodian, and is currently consultant at UNESCAP-GGGI joint-project on Green & Transition Financing, and also Vice-Chairman of Green Energy Finance Committee and Treasurer at the European Chamber of Commerce in Cambodia (EUROCHAM). Varabott has more than 25-years work experience in the Banking & Finance industry across Europe and Asia Pacific (more than 10 years), with an extensive international exposure to Investment Management, Private Equity, Bancassurance and Corporate Advisory missions. Before joining Eurocham, he worked at The Blue Circle and at the Association of Banks in Cambodia (IBF). In Europe, he worked in financial institutions such as Credit Suisse (12 years), Aberdeen Asset Management, AXA Insurance and Banque Hottinger. He holds an MBA from the University of Chicago Booth School of Business, is a Certified European Financial Analyst (The European Federation of Financial Analyst Societies – EFFAS.

-

Mr. Munho ChoiCredit Guarantee & Investment Facility (CGIF)

Mr. Munho ChoiCredit Guarantee & Investment Facility (CGIF)Munho Choi is a Senior Investment Specialist in the Deals Operations Department of Credit Guarantee & Investment Facility (CGIF). He is also a country manager for Cambodia within CGIF. Before joining CGIF, Munho worked at the Export-Import Bank of Korea, where he was mainly responsible for project finance and infrastructure financing in the ASEAN region.

CGIF is a multilateral facility established in November 2010 by the ten members of the Association of Southeast Asian Nations (“ASEAN”), the People’s Republic of China, Japan, Republic of Korea (“ASEAN+3”) and the Asian Development Bank (“ADB”). It was established as a trust fund of ADB with paid-in capital of US$1,149 million from its Contributors. As a key component of the Asian Bond Markets Initiative (“ABMI”), CGIF was established to develop and strengthen local currency and regional bond markets in the ASEAN+3 region. CGIF seeks to provide credit guarantees, mainly in local currencies, issued in the ASEAN+3 region by ASEAN+3- domiciled bond issuers.

-

Ms. Darya SiengSenior Analyst

Ms. Darya SiengSenior AnalystMs. Darya Sieng is currently a Senior Analyst at the Rating Agency of Cambodia (RAC) in the Credit Rating Department. Within her role, she involves in the end-to-end credit rating process, ranging from company and industry research and analysis, financial analysis, industry-specific key ratios, scoring, writing credit rating report to presenting credit rating to rating committee members for review and vote.

RAC is the first credit rating agency in Cambodia, received the license from the Securities and Exchange Regulator of Cambodia (SERC), and is a member of the Association of Credit Rating Agencies in Asia (ACRAA). The Company’s mission is to provide global benchmark-quality credit rating. RAC operates under the three principles of credibility, transparency, and independence.

-

Mr. Rohit DhawanAWS Head of Data Strategy

Mr. Rohit DhawanAWS Head of Data StrategyRohit Dhawan is currently the AWS Head of Data Strategy for Asia Pacific. As an industry veteran, a published author, and a strategy advisor to several C-suite executives, Rohit uses an Amazonian approach to data and AI strategy, working with leading banks and financial services institutions to guide their teams through the digital journey, where customers and markets constantly change in a fast-paced environment that is now commonplace.

Rohit‘s forte is in finding innovative and profitable ways to monetise data – especially in the context of massive industry transformation and digital disruption. He is an early adopter of digital platforms. Prior to AWS, Rohit served as the Head of Customer and Marketing Intelligence at Accenture South-East Asia and as a consultant with Deloitte and IBM in Australia. He retains PhD and Masters from the University of Sydney in data analytics and machine learning.

-

Mr. Samedy SUTSenior Officer in Green Investment at the Global Green Growth Institute (GGGI)

Mr. Samedy SUTSenior Officer in Green Investment at the Global Green Growth Institute (GGGI)Mr. Samedy SUT is a Senior Officer in Green Investment at the Global Green Growth Institute (GGGI). He has extensive experience in investment advice and business modelling, specifically in waste management, sanitation, and energy. Samedy has worked with the Centre International du Crédit Mutuel (CICM) and served as a consultant for various governmental projects and social enterprise programs such as Cambodia Rural Development Team (CRDT) and Hand In Hand Cambodia.

He has over 15+ years of experience in sales, marketing, social enterprise development, investment, financial management, and business development. Samedy has established multiple social enterprises and worked in private companies and non-profit organizations. He has international experience in India, Nepal, Bangladesh, Thailand, Laos, Ethiopia, Malawi, and the United States.

Samedy has collaborated with the Ministry of Economy and Finance (MEF) and the Securities and Exchange Regulator of Cambodia (SERC) to develop sovereign and private green and social bonds. He has gained valuable insight into the effective promotion of thematic bonds as a means of driving sustainable economic growth.

Samedy holds a master’s degree in risk management in Finance, Banking, and Insurance from Nantes University, France, and an MBA in Marketing and Sales Management from Cambodian Mekong University.

-

Mr. TEP BunthoeunSVP & Head of Risk Management Division ACLEDA Bank Plc.

Mr. TEP BunthoeunSVP & Head of Risk Management Division ACLEDA Bank Plc.Bunthoeun is a Senior Vice President & Head of Risk Management Division at the ACLEDA Bank Plc. He also serves as Vice-chair of Sustainable Finance Committee, Association of Banks in Cambodia. In his work experience, He has worked for over twenty years, including more than ten year in internal audit and risk management. He started working for the ACLEDA Bank Plc. in 2002 by passing many function such as accounting, internal auditing risk management, and he was promoted to current position.

He attended advanced courses in risk management and numerous training courses related to Basel Accord, corporate governance, ESG, and internal audit from both prestigious local and international institutions. He obtained a Master’s degree of Finance and Banking (MFB) from National University of Management, Cambodia. He graduated with a Bachelor’s degree in Business Administration (BBA) majoring in accounting at Norton University. -

Mr. Raymond Sia Say GuanChairman of the Association of Banks in Cambodia

Mr. Raymond Sia Say GuanChairman of the Association of Banks in CambodiaMr. RAYMOND Sia currently serves as the Chief Executive Officer/Executive Board Director of Canadia Bank since 2018. He is also the Chairman of Credit Bureau Holding (Cambodia) LTD since 2020 and also serves as the Chairman of the Association of Banks in Cambodia from 2022-2024.

Prior to Canadia Bank, Mr. RAYMOND Sia served in various senior management and leadership roles with international and regional banks in Malaysia and Vietnam, namely Public Bank, Standard Chartered Bank (Malaysia & Vietnam), and Hong Leong Bank (Vietnam) where he was the Chief Executive Officer/General Director.

Mr. RAYMOND Sia has 28 years of Banking, Treasury and Financial Services experience across multiple senior management roles in Cambodia, Malaysia & Vietnam and started his banking career as a Graduate Trainee with Public Bank in Malaysia where he spent 11 years in different roles such as Head of Syndication & Capital Markets and Head of Credit Processing.

At Standard Chartered Bank, Mr. RAYMOND Sia held various senior leadership roles from Director of Local Corporates to Head of Global Corporates, with his last position as Head of SME Banking & General Director/CEO of Hanoi Branch, Standard Chartered Bank.

-

Mr. Rath SophoanVice-chair of the Association of Banks in Cambodia

Mr. Rath SophoanVice-chair of the Association of Banks in Cambodia30 years professional experience with recent 17 years has been in the financial services industry, covering a diverse aspects of banking and life insurance – branch management, Retail, SME and Commercial banking, Operations and Technology. Prior to the appointment as Chief Executive Officer, Maybank Cambodia on 1 July 2022, I had held C-suite roles in the leading international banks and life insurer in Cambodia which include Deputy Chief Executive Officer, Head of Community Financial Services, Head of Consumer Banking and Director of Operations and IT.

I completed the undergraduate degree in Phnom Penh, majoring in Laws with a minor in Business Administration and went on to complete Master of Laws at the National University of Singapore as an ASEAN Fellow. -

Mr. Sukjoon Jeffrey LeeVice President - Sustainable Finance Regional Manager, Second Party Opinion, APAC Moody’s Investors Service Singapore

Mr. Sukjoon Jeffrey LeeVice President - Sustainable Finance Regional Manager, Second Party Opinion, APAC Moody’s Investors Service SingaporeJeffrey Lee is Vice President and Regional Manager for Second Party Opinion (SPO) production for Asia Pacific with Moody’s Investors Service. Based in Singapore, Jeffrey oversees a team of analysts in HK, Singapore and Tokyo, who are in charge of producing SPOs and publication of thought leadership research related to APAC sustainable finance market. Jeffrey is a regular speaker and panelist at external

conferences and other industry events in APAC. He also represents Moody’s on various high-profile industry working groups. Before his current role at Moody’s Investors Service, Jeffrey managed the team of SPO production analysts in APAC with Moody’s ESG Solutions.Before his current capacity, Jeffrey worked in Moody’s Investor Services’ Financial Institutions Group. He joined Moody’s in 2013 as an Associate Analyst covering Korean financial institutions and served several roles within the group since then. Most recently, he was an Assistant Vice President – Analyst and part of the team responsible for portfolio of banks and non-bank financial institutions in South and

South East Asia. Prior to that, he was an Assistant Vice President – Manager and led a team of associate analysts covering financial institutions in APAC. Before joining Moody’s Jeffrey worked at Morgan Stanley’s Institutional Equity Division in South Korea, covering a portfolio of Korean clients. Jeffrey holds a BSc in Economics from Korea University. -

Dr. Dong YuVice President of Sustainability Strategy, Economics & Strategic Planning Department, Bank of China (Hong Kong)

Dr. Dong YuVice President of Sustainability Strategy, Economics & Strategic Planning Department, Bank of China (Hong Kong)Dr. Yu Dong joined Bank of China (Hong Kong) in July 2022 as Vice President of Sustainable Strategy of the Economics and Strategic Planning Department and Researcher of the ESG Research Centre of Hong Kong Financial Research Institute of Bank of China, where he is responsible for sustainability strategy, ESG research, sustainability-related disclosures. Dr. Dong has over a decade of experience in the sustainable development sector. Before joining BOCHK, Dr. Dong worked at Tianda Institute and CITIC Group. Dr. Dong was a postdoctoral research fellow at Guanghua Management School of Peking University, and a senior research fellow of US-China Education Trust.

Dr. Dong received his PhD in Environmental Engineering from The University of Edinburgh. He also holds a Master degree in Sustainable Technology from KTH (Royal Institute of Technology, Sweden). Dr. Dong has earned the CFA Institute Certificate in ESG Investing, the Sustainability and Climate Risk (SCR) Certificate, and the Certified Environmental, Social and Governance Analyst CESGA.

-

Ms. Sharon TohHead of ASEAN region for Swift in Asia Pacific

Ms. Sharon TohHead of ASEAN region for Swift in Asia PacificSharon Toh is Head of ASEAN region for Swift in Asia Pacific, based in Singapore. She leads the relationship management team in ASEAN region, supporting existing customers and expanding businesses in this fast-growing region.

With 26 years’ experience in financial services industry, Sharon has developed deep client relationships across the ASEAN region, with strong connections with banks, corporates, regulators, and market infrastructures.

Prior to joining Swift, Sharon was Sales Director, Indochina at Thomson Reuters, overseeing Thailand, Vietnam, Cambodia, Myanmar, and Laos. Previously, she was Regional Head of ASEAN for the Client Specialist team, responsible for the region’s sales and client training.

In addition to her successful sales career, Sharon has worked in various roles across content acquisition, marketing, and client support at leading financial information providers.

Sharon was voted to the board of EU-ASEAN Business Council in 2022 and serve as its treasurer. She is also deeply committed to diversity, equity, and inclusion. She is now the co-chair of Swift’s gender equality network as well as council member of Women in Payment’s global mentorship council. -

Ms. Song KhenglayExecutive Vice President Chief Operating Officer Canadia Bank PLC, Cambodia

Ms. Song KhenglayExecutive Vice President Chief Operating Officer Canadia Bank PLC, CambodiaMs. Khenglay Song is currently Chief Operating Officer in charge of SME Banking, Branches Network and Bancassurance for Canadia Bank Plc., one of the leading bank in Cambodia. With over 20 years of experience in senior positions, she is responsible to lead various key functions in the bank such as Internal Audit, Centralized Operations, SME Business and Distribution Channel. She has been an active member of Canadia Bank Executive Committee for more than 10 years. And since 2014, she is also a Director of Canadia Bank Lao Ltd., a subsidiary of Canadia Bank Plc. established in Lao PDR. Prior to joined Canadia Bank in 2005, she worked for PricewaterhouseCoopers (Cambodia) for five years as an Audit Supervisor.

Khenglay was educated at National University of Management in Phnom Penh, Cambodia. She is committed to career and ongoing personal development through numerous leadership courses and technical training courses in Auditing, Finance, Banking, Human Resources Management, Leadership for Executives Program organized by Canadia Bank or/ and external training provider in respective field as well as international banks in US, Japan and other countries in the region. -

Mr. MD Shahinur RahmanBusiness Development Manager in GuarantCo

Mr. MD Shahinur RahmanBusiness Development Manager in GuarantCoMD Shahinur Rahman (Shahin) is working as Business Development Manager in GuarantCo, a Development financial institution working in Asia and Africa supporting infrastructure growth. Under his role, he actively works for sourcing transactions in countries like: Bangladesh, Nepal, Sri Lanka, Cambodia, Vietnam, Indonesia, Philippines, Mongolia etc. Before joining GuarantCo, Shahin worked at Project finance and structured banking space for near about 13 years, mostly in the South Asian region. His expertise spans diverse sectors, notably power projects, telecommunications, steel, environmental infrastructure, water treatment, sustainable transactions etc.

“GuarantCo” is part of the Private Infrastructure Development Group (https://www.pidg.org/) and is funded by seven of the G12 governments. Since its inception in 2005, GuarantCo has actively worked to provide innovative credit solutions for infrastructure projects and at the same time developing local currency financing solutions by means of bank financing and/or capital market products. By the means of its “on-demand” credit guarantee, GuarantCo has mobilized c. USD 6.0 billion of investments in 23 countries across 58 transactions thereby helping create 347,000 jobs and providing access to reliable, sustainable infrastructure to more than 45 million people. GuarantCo is rated AA- by Fitch and A1 by Moody’s.

-

Mr. Long VibunrithDirector at the Exchange Management Department (National Bank of Cambodia)

Mr. Long VibunrithDirector at the Exchange Management Department (National Bank of Cambodia)Mr. Long is a Director at the Exchange Management Department with core responsibility focusing on foreign reserve and domestic exchange rate management. Outside of these core responsibility, Mr. Long co-lead the sustainable finance team at the National Bank of Cambodia, developing bank’s strategy and action plans on this agenda. He is also the nominated representative of the National Bank of Cambodia for sustainable finance related work on various international platform such as the Network for Greening the Financial System (NGFS) and working groups under ASEAN.

Mr. Long graduated with a bachelor’s degree in commerce at the University of New South Wales and a Master of Science in finance at the University of Luxembourg. He is also a CFA chartered holder.

-

Mr. Meang TaySVP & Head of Application Service Division

Mr. Meang TaySVP & Head of Application Service DivisionI worked for a different organizations-institutions, including the Ministry of Interior, before joining ACLEDA NGO as a Programmer. I joined ACLEDA Bank full time in June 1999. I was Programmer, Vice President & Deputy Head of IT Division and then promoted Senior Vice President & Head of Application Service Division of ACLEDA Bank from December 2017 till now. As Senior Vice President & Head of Application Service Division, I’m responsible for directing and managing seven departments, with a total of 160 staffs. I managed all Applications in ACLEDA Bank, where I worked for over 23 years. I experience in this technical developing and delivering technical services for ACLEDA’s users & customers, as well as Responsibilities in technical development. I was awarded a Bachelor’s Degree in Science in 1997 from Hanoi University in Vietnam, majoring in Computer Science and Master of ITC from University Utara Malaysia.

-

Mr. Vong ChetraHead of Credit Development and Training Department

Mr. Vong ChetraHead of Credit Development and Training DepartmentI am a holder of a Master’s Degree in Financial and Risk Management, which I earned from the Royal University of Economic and Law. My professional journey has been deeply rooted in the credit field, where I have traversed a diverse range of roles, starting as a diligent credit officer, progressing to a perceptive credit analyst, taking on responsibilities as a secretary of a credit committee, delved into credit operations management and ultimately assuming the pivotal role of a project leader spearheading innovative credit development initiatives.

Having accumulated more than a 10 years of dedicated experience in credit, I have adeptly guided and overseen a number of projects meticulously designed to elevate and refine credit processes and offerings. Throughout this passage, I have marked significant accomplishments, notably the enhancement of credit systems and the introduction of innovative lending products.

-

Mr. Looi Kok SoonDeputy Chief Executive Officer

Mr. Looi Kok SoonDeputy Chief Executive OfficerKok Soon has over 30 years of experience as a banker & entrepreneur in Southeast Asia. He held various positions in distribution and operations at various banks in Malaysia before venturing into his own renewable energy business. He commenced his journey with Prince Bank in Cambodia on 17 April 2023 and is eager to pass on his banking knowledge to the locals and coach them.

-

Mr. OEUR SothearoathChief Executive Officer, Credit Bureau Cambodia

Mr. OEUR SothearoathChief Executive Officer, Credit Bureau CambodiaMr. OEUR Sothearoath is a seasoned Business Analytics leader with more than 17 years’ experience in financial sector, research and development. He is currently serving as the Chief Executive Officer of the company. Prior to assuming this role in 2017, he led the Business Development team at CBC for four years. He has led the company through Digitalization and Analytics transformation enabling the company to launch the 2nd generation of credit score (K-Score), Cambodia’s first mobile app for Integrated Financial Health Check and manage robust technological infrastructure to consistently serve 167+ financial institutions in the country.

Between 2009 and 2013, he served as the Chief of Research and Product Development unit at one of the leading Microfinance Institutions in Cambodia. During this term, he played an instrumental role in creating a dedicated Research and Development team and expanding the market base of the bank by establishing more than 50 new branches. In the past, Mr. Sothearoath also held significant achievements during his tenure with the International Water Management Institute (IWMI) and CARE International in Cambodia.

Mr. Sothearoath received his Bachelor’s degree in Agricultural Economics from the Royal University of Agriculture and an MBA from Norton University. He is also a Tokyo Development Learning Center and Asian Development Bank Certified Microfinance Trainer.

-

Mr. KY SoklayDeputy Director Macro-Surveillance and Supervisory Data Management Department of National Bank of Cambodia

Mr. KY SoklayDeputy Director Macro-Surveillance and Supervisory Data Management Department of National Bank of CambodiaMr. KY Soklay is currently Deputy Director of Macro-surveillance and Supervisory Data Management Department of General Directorate of Banking Supervision. His primary duty is to oversee the conduct of Data Management Division and Credit Bureau Supervision Division. In addition, he leads and advises several working groups such as technology risk supervisory, financial inclusion data, banking supervisory reporting, etc. Prior to the present position, he served as deputy director of Regulatory Policy and Risk Assessment Department, and senior manager at ICT Department for over 10 years, leading Payment System Division innovating the national payment system infrastructure. He has extensive experience in advisory to operation, policy development, business development, information system project and infrastructure governance with several flagship projects, namely Bakong (2020), Retail Pay (2019), Cambodian Shared Switch (2017), Fast Payment (2016) and Centralized National Payment and Settlement Systems project (2012).

Soklay holds master’s degree in information management (New Zealand), MSc in Information Technology (India), and BSc in Computer Science and Engineering (Cambodia). He also earned several key professional certifications e.g., FSI Connect Banking Supervision, IMF Financial Programming and Policies, IMF Public Financial Management, HKU FinTech Professional, PRINCE2® Certification in Project Management Practitioner. He had been a participant, speaker, panelist and trainer in various domestic and international training courses and seminars in payment and settlement, FinTech, banking supervision, payment system oversight, e-commerce, and innovative technologies such as AI & ML, blockchain, big data and cloud. -

Ms. Winnie WongCountry Manager of Vietnam, Cambodia and Laos for Mastercard

Ms. Winnie WongCountry Manager of Vietnam, Cambodia and Laos for MastercardWinnie Wong is the Country Manager of Vietnam, Cambodia and Laos for Mastercard. Since 2018, she has championed digital and cashless payments in these markets and played a key role in engaging regulators and stakeholders in creating cashless and financially inclusive societies.

Currently based in Ho Chi Minh City, she was instrumental in setting up an ecosystem for safe and secure payments to empower businesses and consumers within the markets to seize the benefits and convenience of going cashless.

Winnie is driving Mastercard’s global commitment to inclusion for women by working with local partners to empower women entrepreneurs in the markets with the resources, skills, and knowledge they need to scale and digitize. Her work also extends to boosting banking capabilities that can improve financial access for SMEs/MSMEs.

Having joined Mastercard in 2013, Winnie has worked with governments and corporations to spearhead the adoption of B2B platforms to help improve the efficiency and transparency of cross-border trade in the Asia Pacific.

Winnie has more than 20 years of experience in the financial industry, particularly in commercial payment solutions, with deep insights into the banking and consumer goods sectors. She possesses intensive knowledge of industry best practices that can help markets in accelerating their digital economy. She holds a Bachelor of Business Administration (Honors) from University Putra Malaysia.

Sponsors

-

Cambodia Banking Conference 2023

Cambodia Banking Conference 2023