Cambodia is a bank-based economy. Commercial banks are the primary source of funding. The Cambodian banking system is a two-tier system comprising the Central Bank (National Bank of Cambodia), and private sectors such as commercial banks, specialized banks, microfinance institutions, and a number of NGOs involved in rural credit activities.

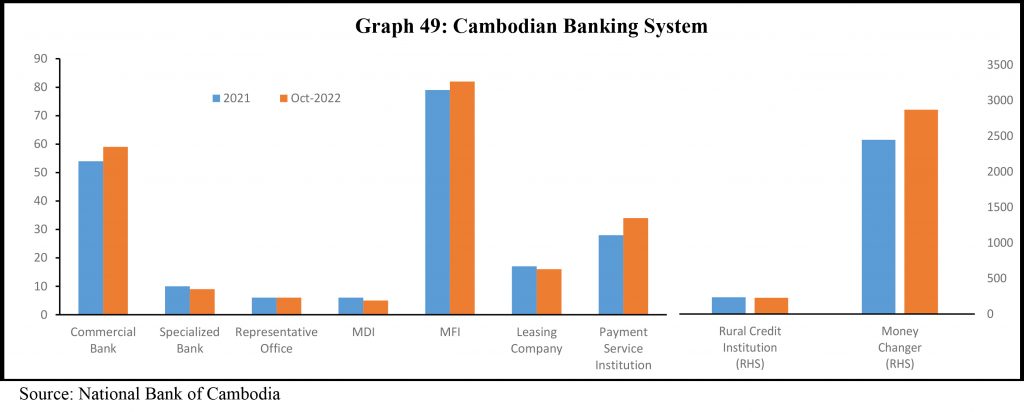

The Cambodian Banking System consists of 59 Commercial Banks, 9 Specialized Banks, 5 Microfinance Deposit-Taking Institutions (MDIs), 82 Non-Deposit-Taking Microfinance Non-Deposit-Taking Institutions (MFIs), 224 Rural Credit Institutions, 16 Financial Leasing Companies, 34 Payment Service Institutions, 6 Representative Offices of Foreign Banks, and 2,869 Money Exchange Agents.

Recent liberal investment regime and open market trade policies have gathered momentum for Cambodia’s economic prospects and banks are also enjoying benefits from such strong growth opportunities. The Cambodian banking sector has been improving and growing steadily over the past two decades; yet; it still lacks of financial depth and is being fragmented. To gain more international confidence, significant progresses are necessitated to address structural distortions such as inadequate legal framework for secured transactions, and information asymmetry arising from poor disclosure standards.