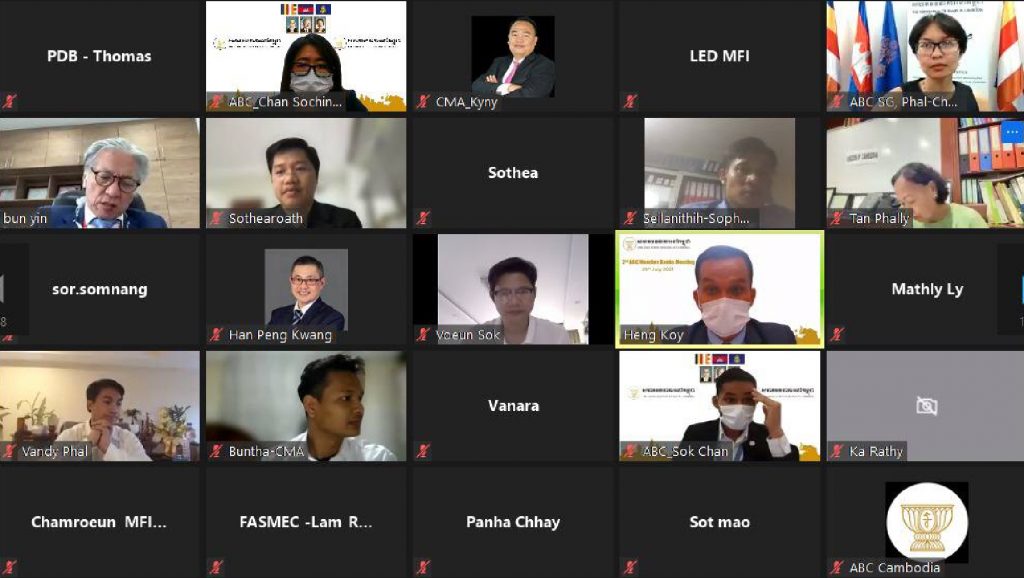

The Association of Banks in Cambodia (ABC) and Cambodian Microfinance Association (CMA) on Thursday 29, 2021 organized a workshop on the Guide on the Interim Implementation of the Revised Lending Guidelines to Prevent Over-Indebtedness”. The workshop attracted around 293 participants from the Banking and Finance Industry through a Zoom Conference.

In the opening remarks, Mr. Bun Yin, Acting Chairman of ABC, said that this joint ABC-CMA Financial Lending Guidelines were designed by the Lending Guidelines Taskforce under the Financial Inclusion Committee based on three main objectives: 1. Better Client Protection Mechanisms to Prevent Over-Indebtedness, 2. Improving Data Reporting, and 3. Preventing Unhealthy Rivalry.

He added that ABC’s Council has accepted the idea of an interim implementation of Financial Lending Guidelines to be a pilot implementation on Multiple Loan Rules Dashboard for Financial Institutions for 3 months, starting from July 01 to September 30, 2021.

He said during that period, feedback and input will be collected to shape the Financial Lending Guidelines to being more comprehensive and inclusive, seeking to be fully implemented by Financial Institutions as of October 01, 2021 onwards.

In the workshop, Mr SOK Voeun, Acting Chairman of CMA, presented on (1) the overview of Financial Lending Guidelines, (2) their revision, and (3) the guide on interim implementation of these Lending Guidelines. Mr OEUR Sothearoath, CBC’s Chief Executive Officer, presented on how these Lending Guidelines are monitored.

During the closing remarks, Mr. Sok Voeun thanked all participants for attending the workshop. He hoped that after the workshop all members will implement the Lending Guidelines as it will be beneficial to the financial sector. Especially in the micro-lending sector, the Lending Guidelines will enable sustainable sector growth and protect customers in order to avoid over-indebtedness.